Tax Evasion In Malaysia

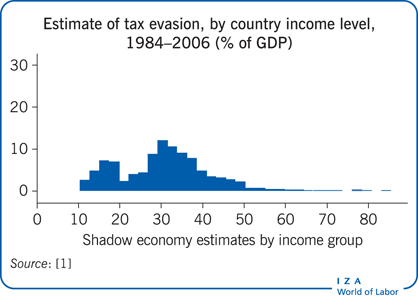

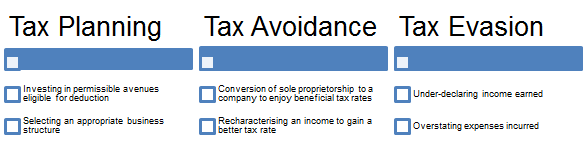

Reasons for t ax e vasion in malaysia just as in any other country to which tax revenue contributes much economic benefit tax evasion harms the governmen t s effort s to allocate revenue for programs and also impairs its ability to provide desirable social services.

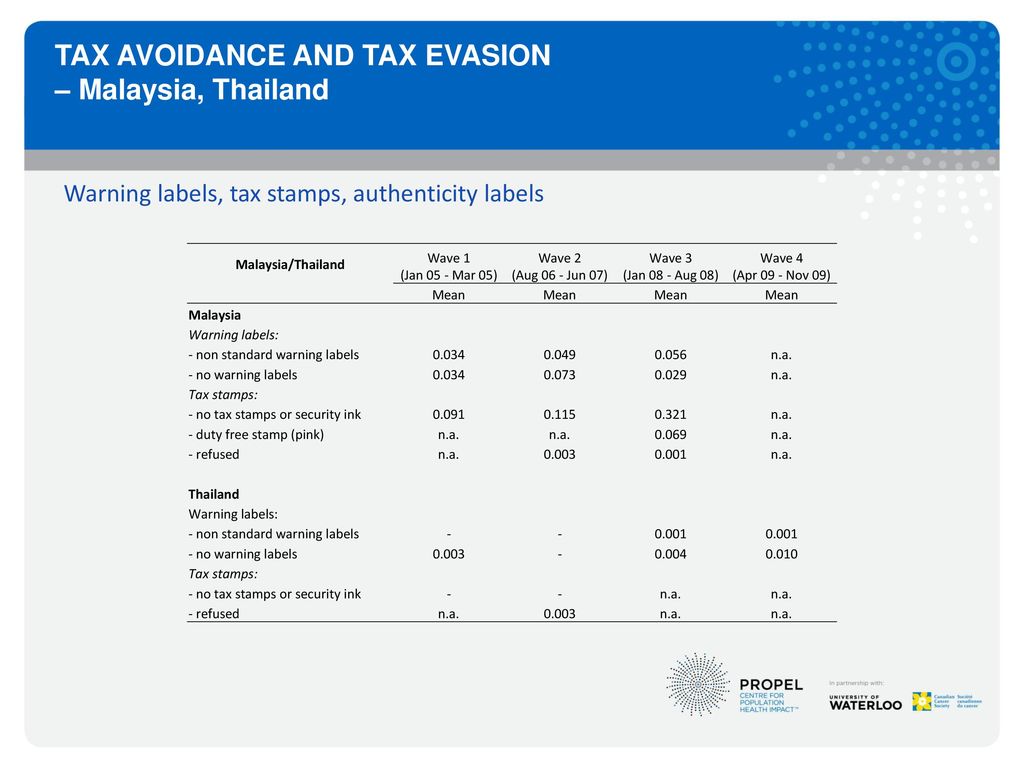

Tax evasion in malaysia. This will help ensure that residents with financial accounts in other countries are complying with their domestic tax laws and act as a deterrent to tax evasion. If you have information about fraudulent or possible criminal activity. As the name implies tax investigation is a method of enforcement conducted by the inland revenue board malaysia irbm to ensure accuracy of tax filing. According to yong it is impossible for tax evasion as malaysia is a participant of several international tax agreements to identify errant individuals and firms.

And that could make you a candidate for a tax audit to verify your tax returns. We are committed to targeting tax evasion and you can help us to make sure everyone pays their fair share of tax. Of tax evasion do not signicantly affect the tax evasion among smes in malaysia in the year 2011. You cannot run if you have.

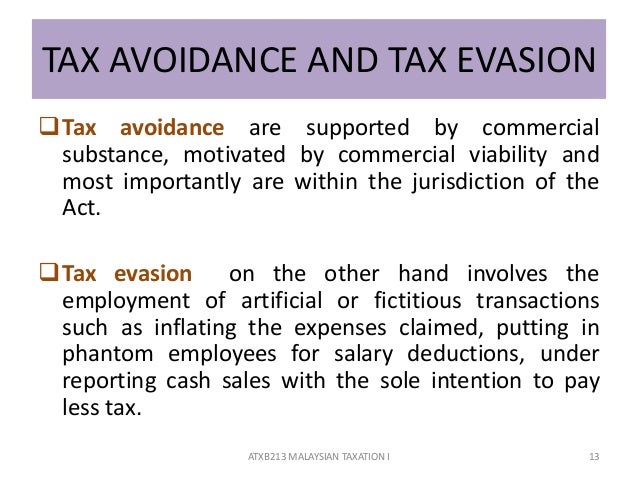

Thus t ax evasion hinders economic development. Tax evasion scheme investment 19h ago mercer ranks malaysia third in asia for retirement income system. As per income tax act ita 1967 any person who committed for an offence will be fine either through penalty of imprisonment or both depending on severity or the number of offences. Houston tech mogul robert brockman charged in record u s.

This is so you don t suddenly fall off the grid which could put you in a high risk profile for tax evasion. Malaysia has committed to exchange the crs information from 2018 and would also be receiving financial account information on malaysian residents from other countries tax authorities. The aim of tax investigations is to investigate taxpayers who are suspected to be involved in fraud wilful defraud or negligence in reporting their income. Lembaga hasil dalam negeri malaysia level 3 menara 2 no.

The negative coef cients for location and the use of a tax agent indicate that sme. 3 jalan 9 10 seksyen 9. In fact t ax evasion is a key reason behind the high national debt level.