Gst Code Malaysia 2017

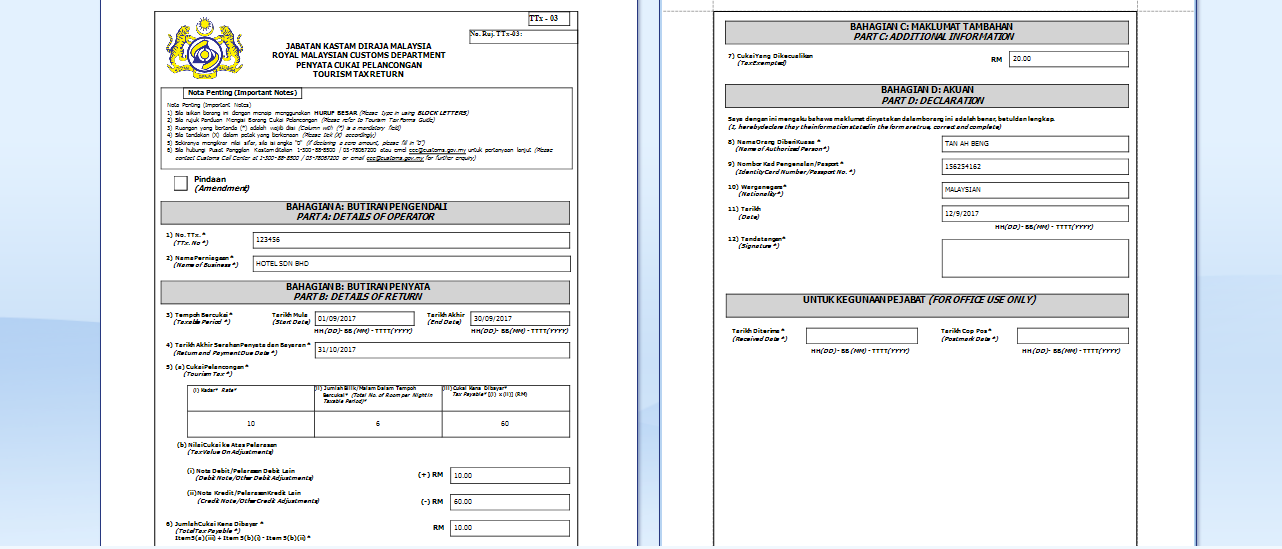

2 tax code on adjustme nt for.

Gst code malaysia 2017. The federal government expects to collect rm41 5 billion in goods and services tax gst this year 0 7 per cent higher than last year s rm41 21 billion. It is envisaged the current hs codes for zero rated goods under the gst zero rated supply order would be amended accordingly to. The goods and services tax gst is an abolished value added tax in malaysia. Gst incurred at 6.

Malaysia brands top player 2016 2017. Tax code description gst 03 os txm 0 this refers to out of scope supplies made outside malaysia which will be taxable if made in malaysia. Apa apa permohonan rayuan cbp. A firm registered with the malaysian institute of accountants.

There is a new gst code which was recommended by customs department specifically for such transaction. Attention please be informed that this portal will remain active until further notice. Updates from the national gst conference other tax information deloitte contacts. Berikutan pemansuhan akta cukai barang dan perkhidmatan 2014 akta 762 yang berkuat kuasa pada 1 september 2018 semua urusan permohonan rayuan cukai barang dan perkhidmatan cbp telah dipindahkan di bawah bidang kuasa tribunal rayuan kastam kementerian kewangan malaysia.

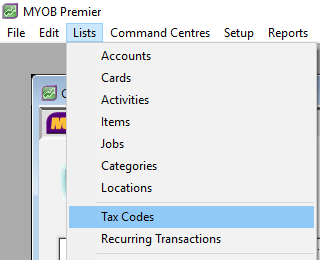

Input tax 6 import of goods. Goods are identified by a 10 digit code instead of 6 digit codes e g. Code for supplies 9 codes 9 1 tax code for purchas es 14 codes 14 tax code for supplies 10 codes 10. As featured in channel newsasia.

The current hs code for trade samples 9800 00 600 will be changed to 9800 00 00 60. Top 10 premium compliance service providers. The existing standard rate for gst effective from 1 april 2015 is 6. The out of scope supply must comply with.

Gst is levied on most transactions in the production process but is refunded with exception of blocked input tax to all parties in the chain of production other than the final consumer. Capital goods purchased from gst registered suppliers and not directly attributable to taxable or exempt supplies. Impact of gst public rulings 3.