Difference Between Takaful And Conventional Insurance In Urdu

Pahang state agricultural development corporation issues four islamic medium term notes worth a total rm335 million us 80 57 million.

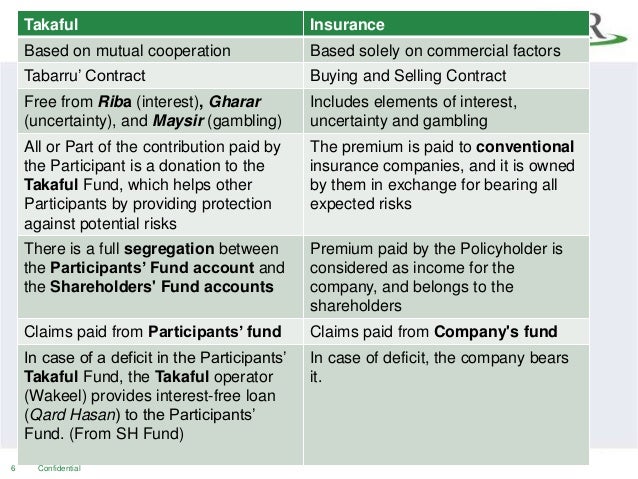

Difference between takaful and conventional insurance in urdu. Bank aljazira records 29 31 decrease in net profit year on year for third quarter of 2020. Having said that there are major differences in the workings of the two systems stemming from the fact that takaful adheres strictly to the islamic principles it was developed upon. Is takaful or conventional insurance cheaper. Takaful is another name of islamic insurance that allows the premiums received from insured to be pooled into a fund to support each other in case someone gets any damage.

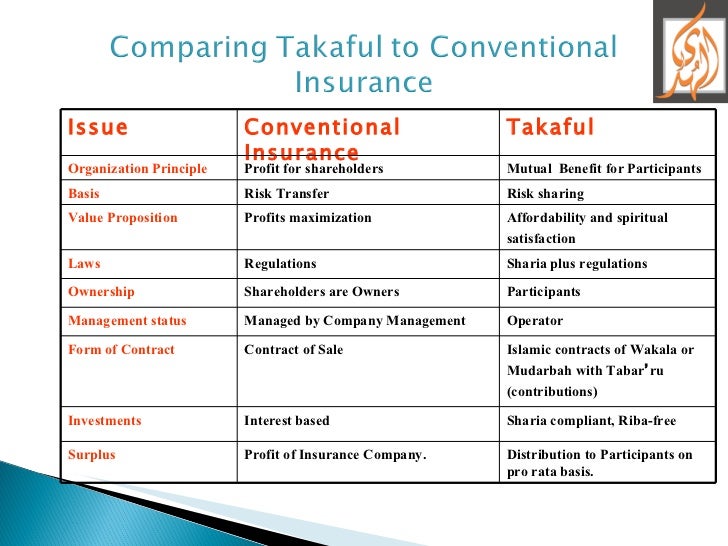

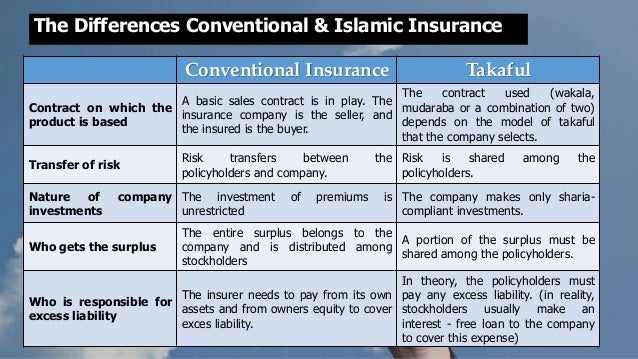

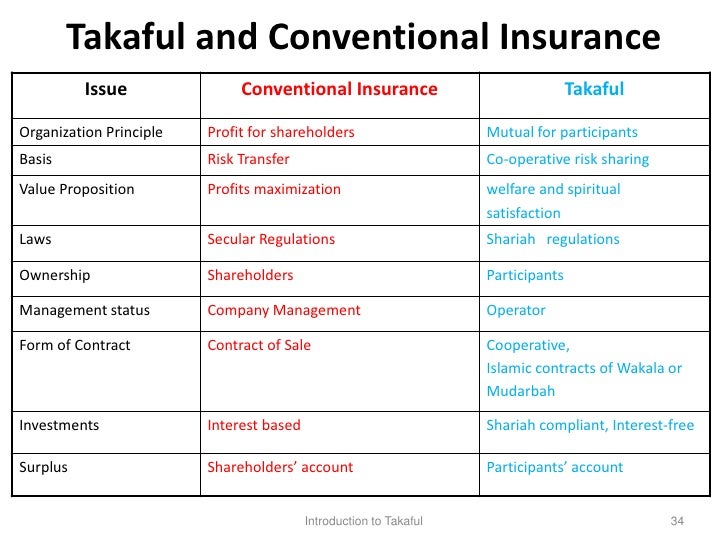

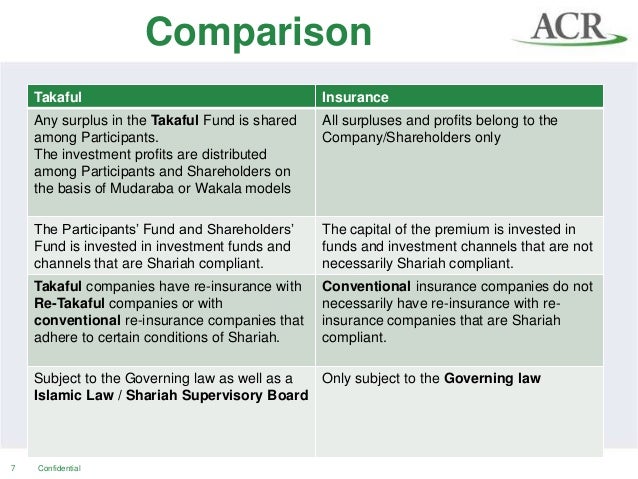

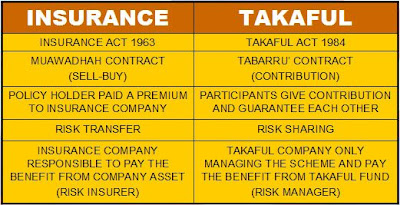

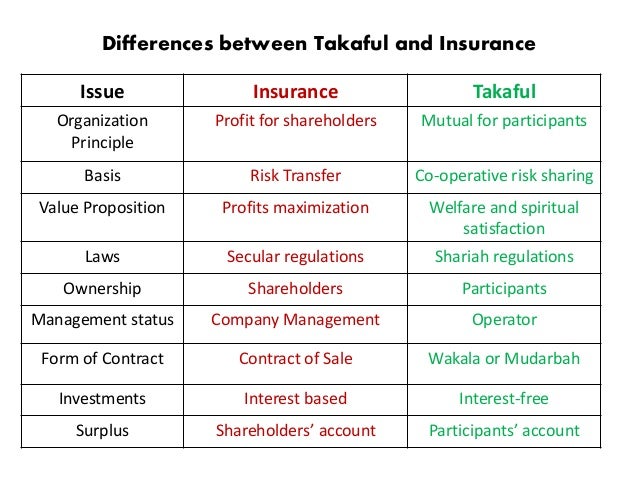

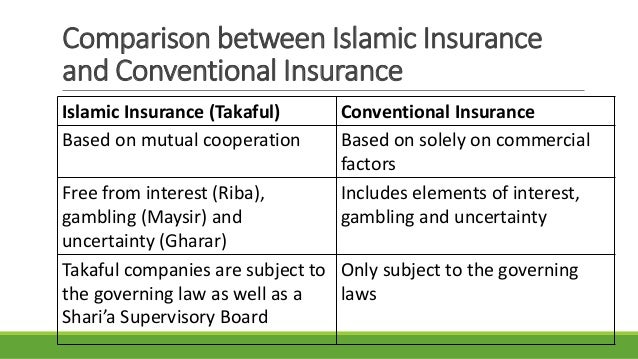

Both takaful and conventional insurance policies work on the same basic system which is the pooling of funds to manage the risk of a group of people. Central ideas and general principle islamic insurance is operation based on al mudharabah financing which is interest free while in conventional insurance it is based on the principle. Although both conventional and takaful businesses generate profits for the shareholders in takaful business the expenses paid to the shareholders are explicitly transparent in conventional insurance they are not necessarily so. This difference can be analyzed under central ideas and general principles external factors essential components and contractual factors.

The difference between takaful and conventional life insurance. Although essentially both takaful and conventional life insurance serves the same purpose of providing coverage there are major differences between the two as can be seen below. There are differences between islamic and conventional insurance. State bank of pakistan confirms reopening of government s sukuk ijarah with announcement of auction dates.

One isn t necessarily cheaper than the other but in terms of extra risk premiums takaful insurance may be better in terms of cost.